Ever feel like your money has a mind of its own?

You think you know what’s in your account, but somehow, by the end of the month, poof!— it’s gone. You’re left wondering, “Did I really spend that much?” (Spoiler: probably yes, but you’re not alone.)

You think you know what’s in your account, but somehow, by the end of the month, poof!— it’s gone. You’re left wondering, “Did I really spend that much?” (Spoiler: probably yes, but you’re not alone.)

The good news? Taking control of your money isn’t rocket science. All you need is a simple system, a pinch of consistency, and a habit loop.

Once you make tracking your finances a part of your routine, you’ll feel like the boss of your budget — and finally know where your money’s hiding.

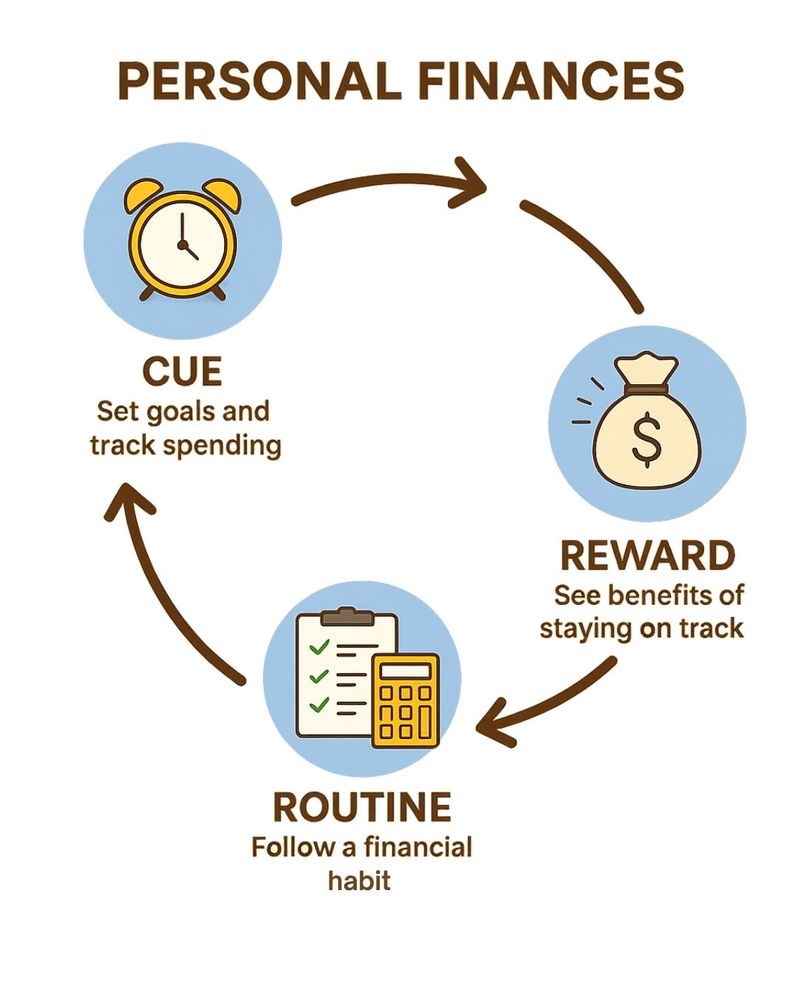

What is a Habit Loop?

A habit loop is your brain’s way of turning actions into autopilot

It’s made of three simple parts:

Cue (what triggers the habit)

Routine (the action you take)

Reward (what makes your brain want to do it again)

So why does this matter for your money?

Because turning money management into a habit means it’ll feel less stressful, more automatic, and actually doable.

Let's walk through how to build your own personal finance habit loop, step by step.

Step 1: Narrow in on Your Goals

To create a habit loop that works for you, you first need to have a clear understanding of your expenses, earnings, and money goals.

Photo by Volodymyr Hryshchenko on Unsplash

Photo by Volodymyr Hryshchenko on UnsplashHow to do that?

Start with the big picture: write down all your yearly expenses — everything you know you'll need to pay for sure (rent, bills, Netflix, car maintenance, etc.).

Next, write down your yearly earnings and savings: how much money you have or earn. This is your starting point.

Now, figure out your monthly costs, splitting them into must-pay (rent, bills) and nice-to-have (hobbies, eating out, shopping).

If it helps, you can divide the nice-to-have costs by week to have a better handle on how much you want to spend.

Tip: Don’t forget to stash some cash for emergencies! Future you will thank you if life ever throws a surprise your way.

Having a clear understanding of your money in and money out can get you excited and confident about controlling your finances.

Quiz

Quiz

Meet Sam:

Brings home $3,000 a month

Must-pay expenses take about $2,200 (rent, bills, groceries, transportation)

Wants to save $400 a month for emergencies

After saving and paying the essentials, Sam has some money left for “nice-to-haves” like hobbies, eating out, or shopping.

Quiz

About how much is realistic to spend on "nice-to-haves" each month?

Step 2: Choose Your Tracking System

Find a tool that works for you. Pick a tracking system that you'll be motivated to use, helping you develop the habit loop and stick with it. Here are some examples:

Apps

Apps

If you want to track your spending right after buying that iced coffee, apps like Monefy or EveryDollar let you log expenses with just a tap.

Best for: People who want convenience and real-time tracking.

Example: Grab a quick lunch → open the app → track spending in 5 seconds. Done!

Spreadsheets (Excel/Google)

Spreadsheets (Excel/Google)

Prefer total control and customization? Spreadsheets let you build your own system — and they don’t share your data.

Best for: Data lovers, privacy-conscious users.

Example: Create a monthly budget table, color-code spending, and track trends over time.

Notebooks

Notebooks

Love journaling or writing by hand? Grab a notebook and make your expense tracker as creative (or simple) as you like.

Best for: Visual thinkers, paper lovers, bullet journal fans.

Example: You design a weekly spending chart with doodles and stickers, and actually look forward to tracking.

Templates

Templates

Want budgeting to feel less boring? Notion or Canva have free templates that look clean, cute, and are easy to fill in.

Best for: Visual learners and people who want “vibe + function”.

Example: You open your Notion page and see your monthly goals, spending categories, and progress — all in one place.

Quiz

Dan is always on the move — juggling work, classes, social engagements, and hitting the gym. What tool do you suggest for Dan?

Step 3: Build Your Habit Loop

Pick your moment (the cue).

This should be a moment that fits naturally into your schedule — something that feels easy and doesn't overwhelm you. A great trick is to attach your tracking habit to something you already do. Here are a few examples:

Right after every purchase (super easy with an app)

Every evening after work/school, as you're scrolling your phone

A weekly “money date” with yourself —make it cozy with tea or snacks!

Once you’ve picked your moment, stick to it. This is the cue, the thing that reminds your brain to start your habit loop: “Hey, time to check in on my money.”

Experience the reward.

Stick to your chosen moment, and by the end of the month you’ll have a clear picture of your expenses. And here comes the reward!

You’ll feel satisfied, less stressed, and start to see the real benefits of staying on track. That sense of control? That’s your brain saying, “Let’s keep doing this.”

You might:

Be motivated to save the money you didn't spend.

See your savings grow and get that “Whoa, I did that?” moment.

Track your wins—like skipping an impulse buy—and reward yourself with a cup of your favorite drink, or a guilt-free scroll through your wishlist.

These little wins add up—and they make your habit loop stick.

Embrace the routine!

When you repeat this cue–reward cycle enough times, it becomes second nature. You won’t have to think twice — it’ll just happen. That’s how you build a money habit loop that lasts.

Quiz

To build a money habit, you need a cue — something that reminds you to track your expenses.

Which of these are good cues for your habit loop?

A. Checking your phone while sipping your morning coffee

B. The moment you get paid

C. A weekly Sunday evening reminder

D. While watching your favorite show

Quiz

Which of these are good cues?

Step 4: Level Up Your Habit Loop

Photo by PiggyBank on Unsplash

Photo by PiggyBank on UnsplashTo level up your habit loop for managing your expenses, it’s a good idea to include a way to save part of your money.

If you want to make saving automatic, look into your bank’s savings options to see if they offer a simple plan.

Many online banks (like Revolut or PayPal) let you create separate savings spaces for specific goals — like vacations, a new laptop, or an emergency fund.

Setting up regular automatic transfers into your savings account helps you build your savings without having to even think about it. Over time, you’ll find you’ve saved more than you expected, and without the stress.

Want to go further? Throw investing into the mix.

Apps like Wealthsimple or Questrade also make it easy to start investing with just a few dollars. You don’t need to be a finance expert — they offer simple, automated portfolios based on your goals and comfort level. It’s a great way to grow your money over time — even while you sleep.

Step 5: Build Mindful Spending Habits

A big part of managing your money isn’t just tracking what goes out — it’s thinking before it goes out.

Before you hit “Buy Now” or swipe your card, pause and ask yourself:

“Do I really need this?”

“Can I do without it?”

“Is this worth the hours I worked to earn the money?”

Make mindful spending a part of your habit loop by adding a fun cue. Before buying anything that’s not essential, try this:

Have a glass of your favorite drink as you ponder your purchase (tea, juice, iced coffee— you pick).

Find a trustworthy accountability buddy with whom you can reason it out and develop a strong "case" for the purchase. Make it into a debate game for some added fun!

Set an alarm for 24 hours — if you still want it, and it fits your budget, go for it. If not, skip it and move on, feeling proud.

You’re training your brain to slow down and recognize the value of your money—and your effort. The more you do it, the easier it gets to spend intentionally and avoid those “ugh, why did I buy this?” moments.

Want to go to the next level? Create your own impulse-buying checklist or decision tree to walk through before every big purchase. Keep a copy on your phone for SOS spending decisions! Here’s one to get you started: Impulse Buying Checklist

Take Action

Start your financial habit loop today!

Your feedback matters to us.

This Byte helped me better understand the topic.